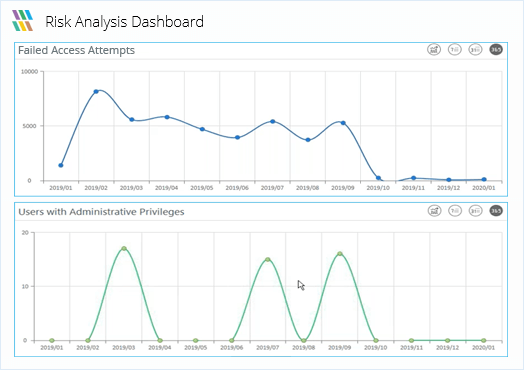

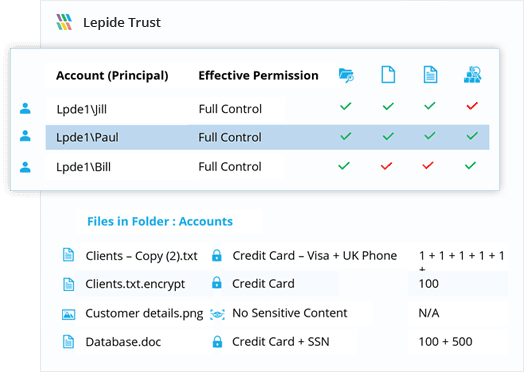

Introduce Visibility and Take the Complexity Out of Compliance

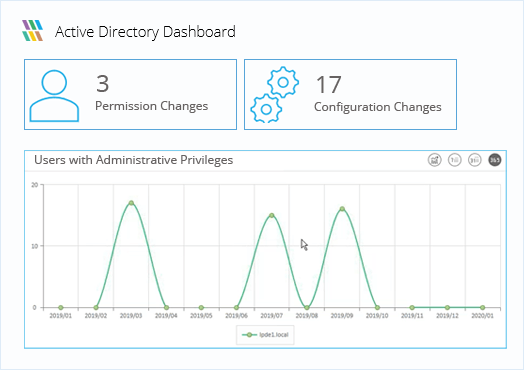

Discover regulated data, ensure that only the right people have access to it, and receive real time alerts whenever anything happens that threatens your compliance standing.

Fill in the rest of the form to

download the 20-day free trial

download the 20-day free trial

x